newport news property tax rate

Real Estate Assessors Office. 7 rows Real Property Tax.

Irs Warns Of Higher Penalties On Tax Returns Filed After September 14 The Irs Warns Taxpayers Who Have Not Yet Variable Life Insurance Tax Attorney Irs Taxes

APRIL 11 2022 With Spring finally sprung around town the Eastons Beach team is gearing up for the start of what is promising to be a busy summer season.

. If you would like an estimate of the property tax owed please enter your property assessment in the field below. Yearly median tax in Newport News City. Last year a microchip shortage slowed the production of new vehicles which in turn.

Newport News City Assessor. 9 hours agoThis decision comes a month after the Town of Middletowns new tiered tax rate system for full-time residents went into effect. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The assessed real estate values in the city have increased across all property types. The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate of 096 of property value. June 5 and December 5.

Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. Newport currently taxes residential and commercial real estate properties at different rates but the city has been exploring tax relief options for year-round residents as opposed to summer home owners since 2020. For more details about taxes in Newport News City or to compare property tax rates across Virginia see the Newport News City property tax page.

Machinery and Tools are limited to property used in manufacturing water well drilling processing or reprocessing radio or television broadcasting dairy dry cleaning or. 2019 tax bills are for vehicles registered during the 2018 calendar year. Machinery and Tool Tax.

Newport News VA 23607 Phone. Vehicles registered in Newport RI are taxed for the PREVIOUS calendar year ie. City of Newport News Code of Ordinances 40-2202.

Newport News City has one of the highest median property taxes in the United States and is ranked 506th of the 3143. Taxes are due in two installments. Newport News City collects on average 096 of a propertys assessed fair market value as property tax.

For questions regarding assessments please call the Commissioner of the Revenue at 757-926-8657. The 104 billion budget proposes dropping the real estate tax rate by 2 cents to 120 per 100 of assessed property value. The tax rate has held steady at 122 since 2014.

We value your comments and suggestions. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Newport News VA at tax lien auctions or online distressed asset sales. The City of Newport News charges a tax on Machinery and Tools used in a business or to earn income within the City.

Seasonal Beach Parking Stickers are now for sale at the Collections office at. 700 Town Center Drive. Personal property taxes apply to cars trucks buses.

What are the property taxes in Newport NH. As of January 1 2007 city decals are no longer required in Newport News. Real Estate Assessors Office Department Overview.

Newport News VA 23607. If you believe any data provided is inaccurate please inform the Real Estate Assessors Office. Learn all about Newport News County real estate tax.

The assessed value multiplied by the real estate tax rate equals the real estate tax. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. Eastons Beach Parking Passes Available at City Hall NEWPORT RI.

Newport News City Council voted to ease the property tax burden on city residents for the current calendar year. The Treasurers office will be assessing a Vehicle License Fee VLF. The Newport News Real Estate Assessors Office receives its authority from the Virginia Constitution various statutes of the Commonwealth of Virginia the Newport News Charter and City Code.

The current real estate tax rate for the City of Newport News is 122 per 100 of your propertys assessed value. 8 AM - 5 PM. Newport News VA 23606.

How can we improve this page. If you have a specific question regarding personal property tax please consult our Personal Property FAQ or call the Treasurers Office at 757-926-8731. 757-247-2500 Freedom of Information Act.

Our office administers the personal property taxes as they are determined by the City of Newport News. The real estate tax rate is determined by City Council and the City Treasurers. Eastons Beach Gearing Up for Busy Summer Season.

Send Instant Feedback About This Page. The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. 1399 per thousand Motor Vehicle Accounts.

Appealing Your Property Taxes Consider Expert Help Tax Attorney Property Tax Tax

Pin By Arazi Center On Property Property Ocean View Apartment Different Types Of Houses

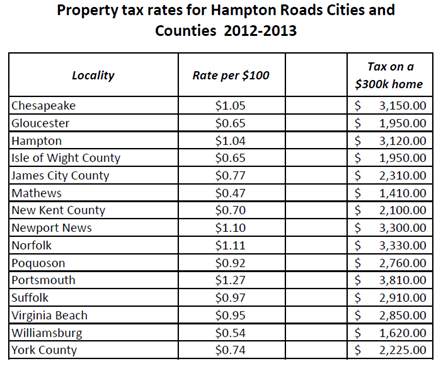

Hampton Roads Property Tax Rates 2012 2013 Mr Williamsburg

Your Tax Return Bring It Home Fixed Rate Mortgage Investment Property Home Buying

Want To Save A Few Bucks Where Property Taxes Are The Highest And Lowest Refinance Mortgage Home Buying Mortgage Loans

Property Tax Bills May Amount To A Lot Of Money And Can Be A Burden For Pennsylvania Residents No One Likes To Pay High Property Tax Home Appraisal Estate Tax

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Finding Your Next Home Could Be Just A Click Away Call Me To Get Started Tami Savage Florida Flori Next At Home Waterfront Homes For Sale Finding Yourself

Bahria Enclave Heights Bahria Enclave Ocean View Apartment Different Types Of Houses

Getting Smart With Real Estate Investing Instead Of Stocks Investment Properties Mexico Home Loans Home Trends The Borrowers

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga

If Someone You Know Is Still Renting You May Have Heard Them Mention One Of The Following Myths About Purchasin Mortgage Payment Mortgage Interest Home Buying

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

Pin By Elizabeth Sorgen Santa Monic On Real Estate Listing Presentation Real Estate Real Estate Agent

Property Tax In Pakistan 2021 22 Moving Apartment One Bedroom Apartment Separating Rooms