wa sales tax finder

Name save and share locations via email or text message. If you need access to a database of all Washington local sales tax rates visit the sales tax data page.

Simplify your sales tax registration.

. The seller is liable to the Department of Revenue for sales tax even if it is not collected. Businesses with multiple work sites or delivery locations. Sales tax is governed at the state level meaning each state sets their own laws and rules when it comes to sales tax.

The average cumulative sales tax rate in Seattle Washington is 1021. Find your Washington combined state and local tax rate. Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device.

Sales tax is based on the business location. Tax rate change notices. With local taxes the total sales tax.

Decimal degrees between 450 and 49005 Longitude. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation districts. Build your own location code system by downloading the self-extracting files to integrate into your own accounting system.

Turn on in-app Service alerts to. Click any locality for a full breakdown of local property taxes or visit our Washington sales tax calculator to lookup local rates by zip code. Whether youre on a job site delivering items or in a store check this app to verify the correct sales tax rate.

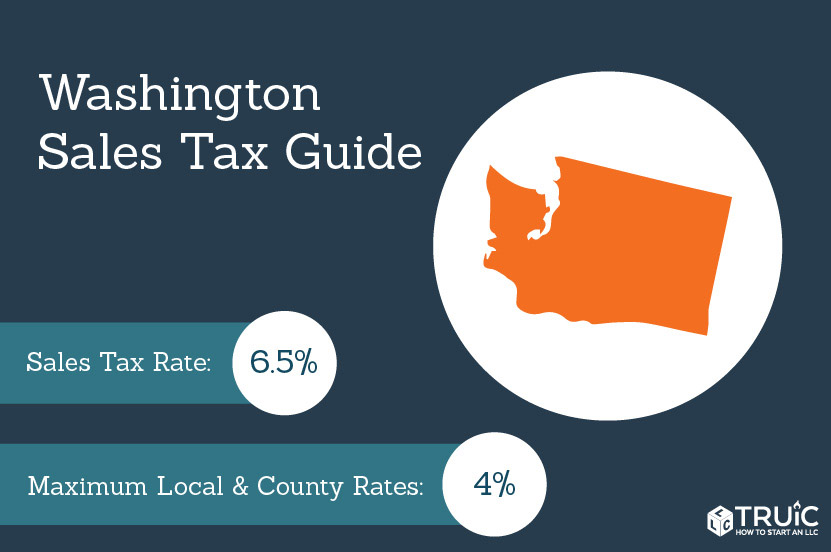

Decimal degrees between -1250 and -1160. Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 31. Lodging information and rates.

Washington has 726 special sales tax jurisdictions with local sales taxes in. WA Sale Tax Lookup is architected as a standalone application or microservice so that youre not dependent on the State of Washingtons IT infrastructure. Information and rates for car dealers leasing companies.

Seattle is located within King County Washington. Counties and cities can charge an additional local sales tax of up to 31 for a maximum possible combined sales tax of 96. Find Sales tax rates for any location within the state of Washington.

Determine the location of my sale. Lookup other tax rates. Groceries and prescription drugs are exempt from the Washington sales tax.

Once this app has cached the sale tax data from the states website which happens on start up youre good to go until the next quarter. Put your rates to work by trying Avalara Returns for Small Business at no cost for up to 60 days. Washington sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Find your local sales tax rate by GPS or by searching an address. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on top of the state tax. Sales tax rates can be made up of a variety of factors.

Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue. Identify and apply for business licenses. Tax rate lookup mobile app.

There is no national or federal sales tax. To calculate sales and use tax only. All have a sales tax.

The base state sales tax rate in Washington is 65. Use tax is paid by the consumer when retail sales tax was not collected by the seller. Apply more accurate rates to sales tax returns.

Sales of motor vehicles trailers semi-trailers aircraft and watercraft. Retail sales tax includes both state and local components. Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104.

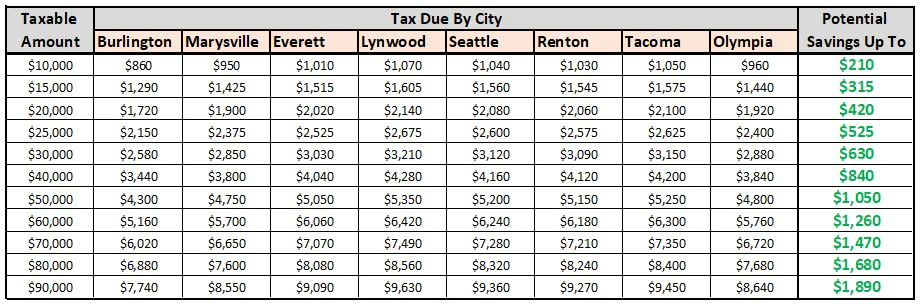

This means more than 50 of gross sales from retailing fresh cut flowers arrangements and similar products that are not used for landscaping purposes. After choosing the number os Locations to compare a list of. Enter the taxable amount to calculate the total charge with sales tax.

What is the state tax rate in WA. Download your saved locations text or CSV for use in filing your tax returns. The state sales and use tax rate is 65.

The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. You can now choose the number of locations within Washington that you would like to compare the Sales Tax for the product or service amount you entered. 31 rows The state sales tax rate in Washington is 6500.

Use this search tool to look up sales tax rates for any location in Washington. Sales tax is based on the sellers location even if the seller delivers the items to the customer. Local sales and use tax rates range from 05 to 4 depending on the location.

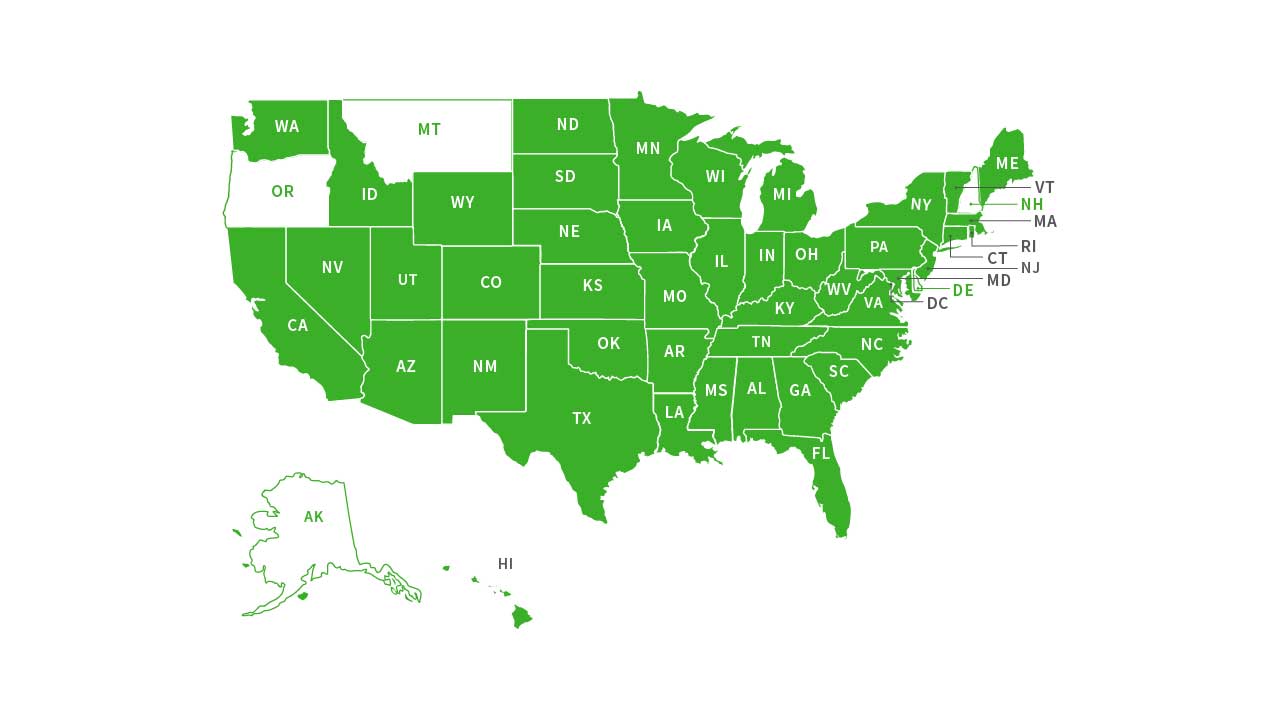

Find out what each state has to say about sales tax here. Find the TCA tax code area for a specified location. --ZIP code is required but the 4.

Show full articles without Continue Reading button for 24 hours. This means that depending on your location within Washington the total tax you pay can be significantly higher than the 65 state sales tax. As far as sales tax goes the zip code with the highest.

Within Seattle there are around 56 zip codes with the most populous zip code being 98115. Forty-five states and Washington DC. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen.

Use one form for all the states where you need to register. This includes the rates on the state county city and special levels. List of sales and use tax rates.

What Amazon Fba Sellers Need To Know About Washington Sales Tax After January 2018 Taxjar

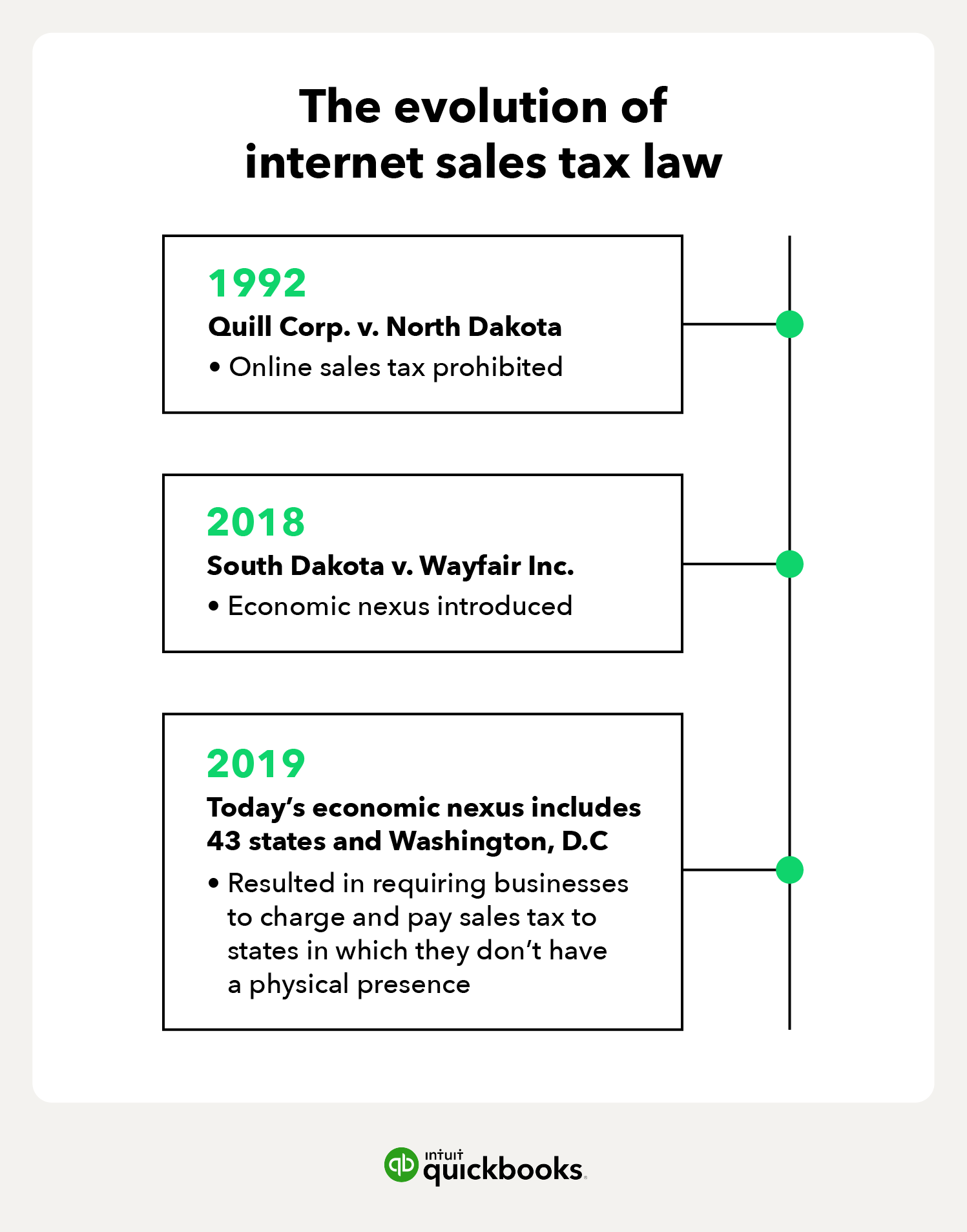

Internet Sales Tax Definition Types And Examples Article

Washington Sales Tax Rates By City County 2022

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Washington Income Tax Calculator Smartasset

Washington State Sales Use Tax Location Code Boundaries Overview

States With Highest And Lowest Sales Tax Rates

Auto Sales Tax Calculator Buy A Vw Near Marysville Wafacebook

Washington Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Grocery Items Taxjar

The Consumer S Guide To Sales Tax Taxjar Developers

Is Software As A Service Saas Taxable In Washington Taxjar

Washington Sales Tax Small Business Guide Truic

Washington Secretary Of State Wa Sos Business Search Secretary Of State Corporation Search